coinbase vs coinbase pro taxes

While Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS. Taxes are based on the fair.

Coinbase Vs Coinbase Pro Is The Upgrade Worth It Zenledger

Still Coinbase does have apps on Android and iOS for both its basic service and its Pro offering.

. What a 1099 from Coinbase looks like. My guess is they are phasing out Pro eventually. Once you figure out the.

Theyve dropped 84 from. If you are a non-US Coinbase customer you will not be sent any tax forms by Coinbase but you can still generate reports on the platform and then use these for. In order to pay 15 tax I plan to hold them for at least 1 year.

No GDAX was always run by Coinbase. This guide examines Coinbase and Coinbae Pro platforms account options and compares them based on features security. It was actually originally called Coinbase Exchange which was renamed to GDAX then Coinbase Pro.

Crypto mined as a business is taxed as self-employment income. On Coinbase Pro I didnt to anything yet. Note Coinbase Pro is one of the highest fees in the US among pro exchanges so the fees are not great for a pro exchange.

05 fee per trade higher for crypto to crypto conversions plus a Coinbase Fee which is the greater of a flat fee or percentage fee depending on location and other factors. While the Coinbase Pro costs more to buy it has significantly fewer fees than the simpler Coinbase. I brought about half of my crypto with Coinbase transferred it over to Coinbase Pro and then bought more of that crypto with Coinbase Pro and then ultimately sold that crypto.

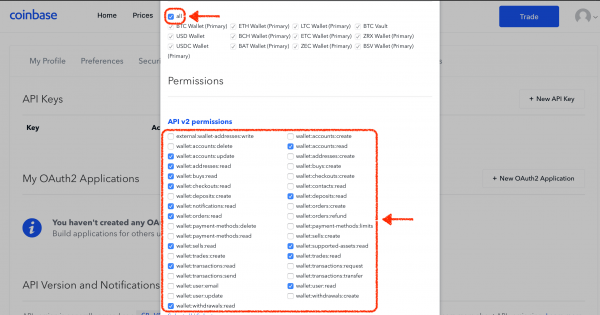

You can automatically import your Coinbase Pro transactions using an API connection or import them manually through a CSV file. 0-05 fee depending on the size of the order and whether youre a maker or taker. Yes youre paying for convenience but.

Pro just refers to the interface. Coinbase Tax Resource Center. It was originally a different exchange called GDAX that Coinbase bought and rebranded.

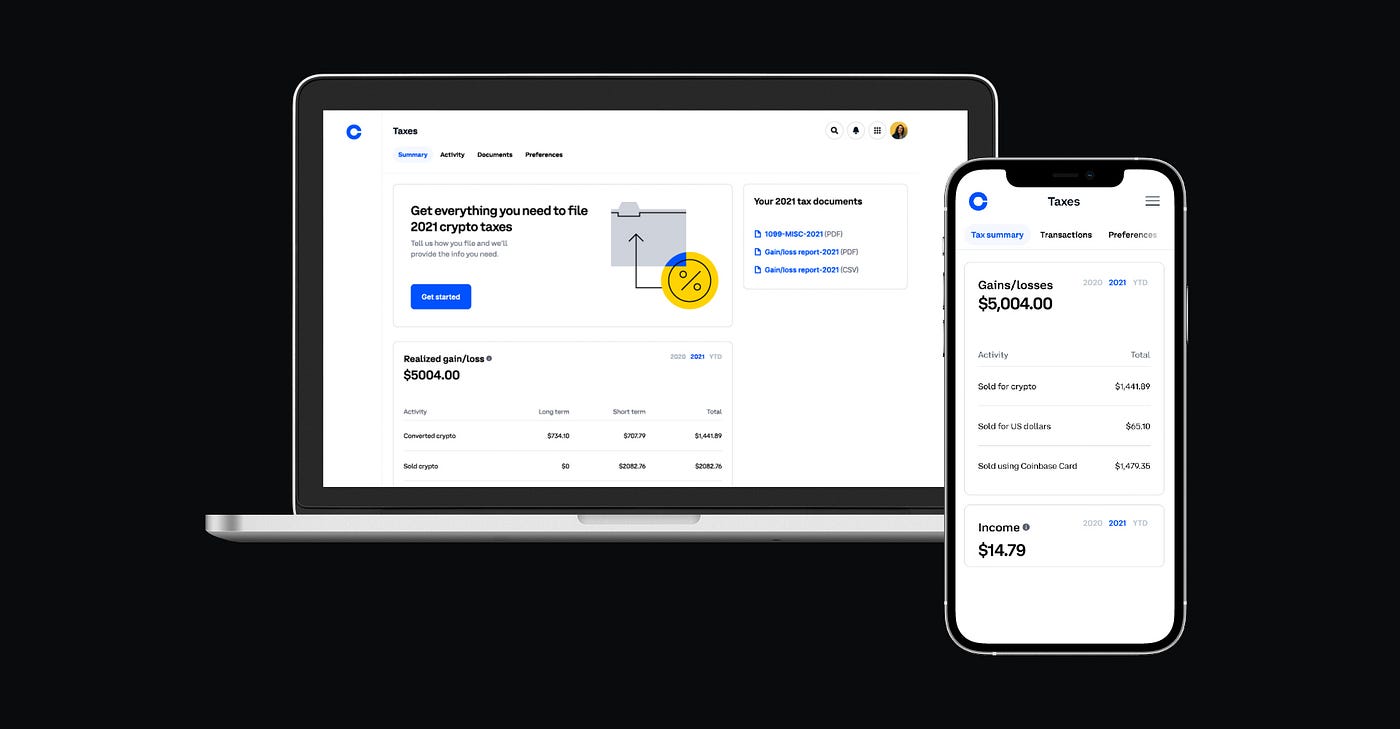

If you are subject to US taxes and have earned more than 600 on your Coinbase account during the last tax year Coinbase will send you the IRS Form 1099-MISC. While Coinbase is more suited to beginners Coinbase Pro is a sophisticated trading platform for more experienced investors. Bank transfers come with a 149 fee for buying and on the exchange the makertaker system comes with costs of between 01 to 025 depending on the volume you trade.

Staking rewards are treated like mining proceeds. Within CoinLedger click the Add Account button on the top left. Before I start trading on Coinbase Pro Id like to know more about how taxes are.

Resident for tax purposes and earned 600 or more through staking USDC rewards and Coinbase Earn rewards which are all considered miscellaneous income. Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. This is the key point that people saying only oh youre paying for convenience or noob tax are missing.

If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. The taker fees and maker fees are massively less and fixed than Coinbase which offers a variable fee amount with more standard fees. I deposited 1000 but didnt buy anything yet.

Coinbase and Coinbase Pro are two distinct platforms owned by the same holding company Coinbase Global Inc. When they send out your tax info will it all be in one document or. On Coinbase I bought ETH to hold.

1 day agoAt last check on Wednesday Coinbase shares had lost nearly a quarter of the market value they held on Tuesday. Both Coinbase platforms allow you to purchase cryptocurrency in dollar amounts allowing you to buy fractions of coins. Coinbase Pro is cheaper because youre doing all the work.

I have had my coinbase account since 2016 never any issue using it except for the occasional re-verification of my identity ever year or so. Coinbase Pro has the fee range of 0 to 5 per trade regardless of the traders transaction type. 2 days agoCoinbase offers its Coinbase Pro exchange which uses a tiered makertaker model but that is a separate system.

Fees on Coinbase Pro are significantly cheaper than fees on the standard Coinbase platform. Coinbase Pro offers traders margin trading services with allowance for up to 3X leverage on BTCUSD and ETHUSD with a 10000 limit. The basic service had an.

Coinbase has a 2 minimum order amount and Coinbase Pro has no minimum dollar requirement though the order cannot be smaller than 0001 BTC 001 BCH 001 ETH or 01 LTC. But it is important to highlight there are wire transfer fees which are a 10 fee per deposit and a 25 fee per withdrawal fee. Youll receive the 1099-MISC form from Coinbase if you are a US.

However it says it intends to do so in mid-2022. The most distinct feature differentiating the two platforms is the fee structure. I bought and sold 40000 in crypto last year on coinbase pro no issues I leave 6000 in crypto on coinbase for 10 months no issue I change my bank account 4 days ago sell some of my ethereum and cash out and I come back yesterday.

Find Coinbase Pro in the list of supported exchanges and select the import method you prefer.

The Ultimate Coinbase Pro Taxes Guide Koinly

How To Use Your Coinbase Api Key Full Guide Crypto Pro

What S The Difference Between Coinbase And Coinbase Wallet Coinbase

Cardano Is Launching On Coinbase Pro Big News For Cardano Holders Ada Project Success Success Stories Investing

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

![]()

Using Turbotax Or Cointracker To Report On Cryptocurrency Coinbase Help

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

Coinbase Learn Ihre Kryptofragen Werden Beantwortet

Coinbase Starter S Guide Bitcoin About Me Blog Cryptocurrency

Best 9 Upcoming Defi Tokens Are The Tokens That Will Launched Soon Top Investors Like Binance Coinbase Are Behind These Pro In 2021 Best Crypto Bitcoin Account Token

Cointracker Is The Most Trusted Bitcoin Tax Software And Crypto Portfolio Manager Automatically Connect Coinbase Binance And In 2021 Tax Software Tax Guide Bitcoin

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Step By Step Guide How To Set A Stop Limit Stop Loss On Coinbase Pro 4k Youtube Technical Analysis Software Step Guide Technical Analysis

:max_bytes(150000):strip_icc()/unnamed-3-ca8da14bd65a4973ab92b18cd3940a89.jpg)